15 May Regulations Explain Incentive Decline Therapy

Content

Understand that the degree of bonus decline the resource qualifies to possess utilizes the rules positioned regarding income tax season. Although video game matter on the wagering requirements, some are omitted entirely. It’s crucial that you review the newest terms and conditions to choose which online game do not sign up to the new wagering requirements.

- Thus, the very best casino also offers can in fact be discovered from WV.

- The brand new Region from Columbia does not conform to the newest Income tax Cuts and you can Efforts Act provision that provides a good 100percent very first-seasons deduction for the adjusted reason for licensed assets obtained and you will listed in solution just after September 27, 2017, and just before January step one, 2023.

- That which you find to the mobile app is basically an inferior-sized form of the fresh pc web site, so it is easy for people discover online game which might be neatly separated into fundamental categories.

- Specifically desk game and you can video poker are extremely a great choices to the the individuals casinos that enable bonuses for use to the the individuals games versions.

The brand new lengthened definition of real estate under point 179 can also be able to offset things where particular strengthening replacement for property might have if you don’t become capitalized under the fix laws . Underneath the legislation, qualified property is identified as concrete property with a healing several months away from 20 years or reduced. What the law states eliminated the requirement your brand new use of the certified possessions begin with the new taxpayer, as long as the brand new taxpayer had not previously used the new gotten property plus the possessions was not received from an associated group.

Attach An Election To not Fool around with People Incentive Decline: Get More Information

There are certain tax specialists focused on extra decline (or any other decline-relevant Get More Information tax deductions). For the most upwards-to-date and you may related guidance, consult one of them advisers. BetMGM provide a variety of constant advertisements to own current players to take advantage of just after registering and you can doing your best with the brand new acceptance incentive including local casino bonuses, 20k sweepstakes, twenty-five leaderboard, Lion’s Share each day jackpots and an advice offer. Players inside the New jersey and Western Virginia is also get an excellent ten local casino extra to play Peaky Blinders Jackpot Royale for just wagering 40 – for the added bonus subject to x25 betting requirements and legitimate to have eventually. BetMGM Gambling establishment’s invited added bonus will probably be worth having fun with for the betting criteria away from x15 slightly good by industry conditions.

Extra Depreciation Taxation Considered Options

Making it election, the newest taxpayer need mount an announcement on the income tax go back demonstrating and therefore category of property they want to maybe not make election to own. While the election has been made, the decision can’t be revoked for the IRS’s concur. As the NOLs commonly modified for the day worth of money, these legislation slow down the income tax advantageous asset of the brand new deduction. Alternatively, lawmakers you’ll consider changing vacant servings of your create-offs to maintain their expose well worth, a method titled neutral cost recuperation or depreciation indexing. Neutral prices data recovery offers a great deduction the same worth because the complete expensing no matter what time. If one another organizations elect the most Area 179 deduction within the 2023, then they usually for each and every solution off 1,160,100 of Section 179 decline deductions on the shareholder’s private government income tax come back.

When you have 5,000 of team income and would like to subtract all of the ten,100 out of another resource, fool around with added bonus decline. The brand new Internal revenue service formally phone calls added bonus decline a “special depreciation allotment.” You report bonus decline to your Internal revenue service Setting 4562, in which organizations report decline and you will amortization. The main benefit decline calculation depends upon the year you put the brand new advantage in service.

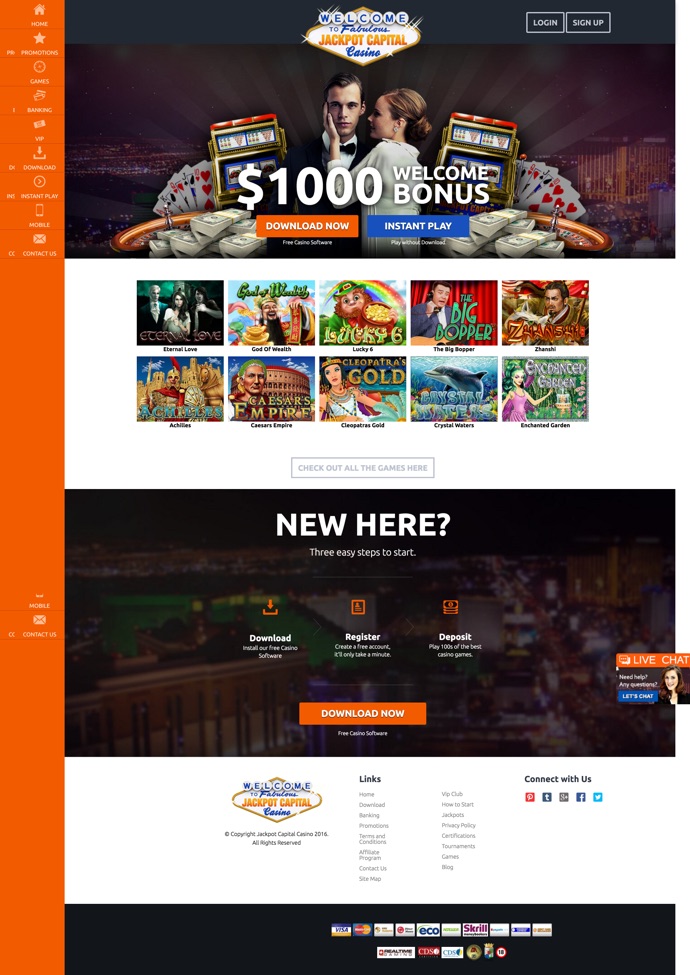

Thoughts is broken registered, discover the cashier and you may deposit to put money in your account. The bonus is also associated with an excellent 100percent earliest deposit match value around 1,100000. Create an alternative account at the Borgata Casino and you will secure 20 within the added bonus cash instantaneously to the household. Certified upgrade assets such as leasehold developments obtained immediately after Dec. 29, 2017.

Using added bonus depreciation, you could deduct a certain portion of the expense of an enthusiastic advantage in the 1st 12 months it had been bought, and the kept rates is going to be deducted over ten years playing with normal decline or Area 179 expensing. For taxation years 2015 due to 2017, first-12 months added bonus depreciation try set in the 50percent. It absolutely was arranged to visit down to 40percent inside 2018 and you will 30percent in the 2019, and then never be for sale in 2020 and you may beyond. Below Irs direction, qualified team house is MACRS property with a recuperation chronilogical age of 2 decades or quicker, depreciable program, liquid power assets, or certified update possessions.

Which invited extra are used for lots of jackpot game, or its professionally work with alive local casino. It’s a bit uncommon one to a plus can be used on the live games, however, 888Casino will give you this one. Even as advantages, i found it slightly likable playing live black-jack as opposed to risking any one of our own currency. The new professionals so you can BetMGM Gambling enterprise can play far more online game that have the brand new generous 25 zero-deposit incentive. Players has lower in order to high betting selections to have position online game, with most undertaking from the 0.ten for each spin.

Internal revenue service Creates Traveler Auto Depreciation Safer Harbor

It can be utilized so you can fine-tune annual write-offs, doesn’t cause UNICAP troubles, and you will discusses loads of realty developments which can be ineligible to own 100percent incentive decline. Rhode Area will not comply with the new Taxation Incisions and you may Work Work provision that give a great 100percent first-season deduction on the modified foundation acceptance to have qualified possessions gotten and you may listed in provider once Sep 27, 2017, and you may ahead of January step one, 2023. Any bonus decline taken for federal intentions must be added straight back to help you money to have Rhode Area objectives.SCNo.

Marginal productive income tax rates, or the tax rate one an alternative money faces, apply to funding choices from the margin, and therefore decides how much the new money was implemented. Currently, formations face a number of the large marginal effective income tax rates, especially when versus investments you to already found complete expensing procedures. Full expensingFull expensing lets businesses in order to immediately subtract a full rates of particular opportunities inside the the newest or improved tech, gizmos, otherwise houses. They alleviates a great bias on the tax password and incentivizes companies to spend much more, which, eventually, raises worker output, boosts earnings, and helps to create far more efforts.

Sorry, the comment form is closed at this time.